The Brief

Fermi Energy developed a proprietary manufacturing process for cathode active materials that significantly reduces production costs and energy consumption. They had strong technical fundamentals (ex-Tesla team, university research backing, pre-order traction) but needed investor materials that could translate complex battery chemistry into clear competitive advantage without overexposing technical details.

Visual Translation

Problem Visualization with Scale

Opened with battery cost breakdown showing cathode’s dominant

share of total battery cost—oversized typography making market

significance impossible to miss. Problem slide featured industrial

manufacturing imagery with CAPEX/OPEX comparison visualizing

current industry inefficiencies at scale.

Solution Through Process Comparison

Created nested circle visualization showing global market, U.S.

addressable market, and current customer demand. Clean,

memorable, instantly communicates market depth and near-term

opportunity. Included proof point of existing customer commitments

for specific annual capacity.

Platform Technology Through Microscopy

Showcased the flexible production capability with grid of electron

microscope images showing range of product variations and surface

treatments. Technical credibility through actual product imagery

demonstrating manufacturing versatility across applications.

American Manufacturing Identity

Navy and red color palette chosen specifically to emphasize U.S.

production positioning—reinforcing domestic manufacturing

messaging and supply chain security value proposition.

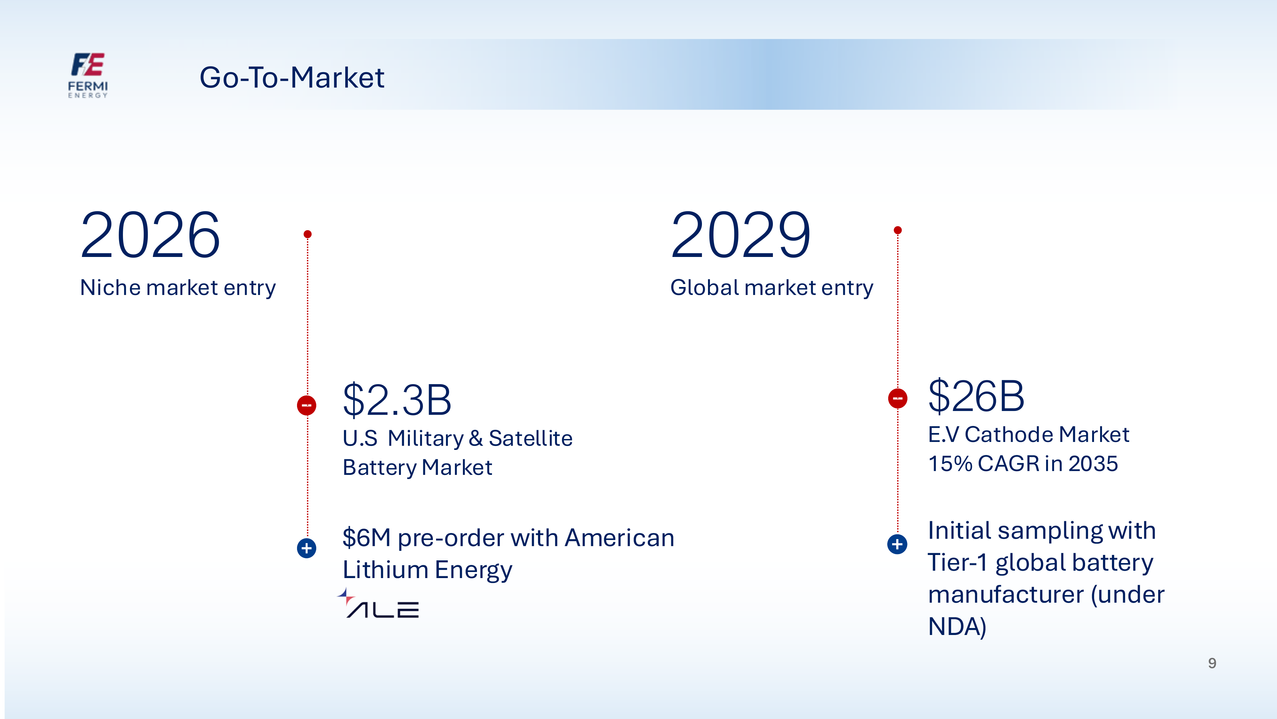

Go- To-Market Timeline

Built a two-phase market entry strategy as visual timeline: initial

niche market entry (military/satellite applications with named

customer commitments) leading to broader market expansion (EV

cathode market with Tier-1 manufacturer partnerships). Showed

strategic progression from proven niche to massive scale.

Revenue Model with Unit Economics

Designed dual visualization: production volume progression over five

years alongside revenue growth projections. EBITDA margins

displayed separately showing healthy profitability trajectory . Color-

coded bars using brand palette to maintain visual consistency.

Competitive Positioning

Created advantage matrix showing Fermi Energy’s key differentiators

against named competitors in the space. Used checkmark callouts to

emphasize core competitive advantages: technical performance

metrics, manufacturing efficiency gains, and improved unit

economics.

Investment Ask Structure

Presented three-stage funding roadmap mapped to production

milestones (pre-pilot, pilot, post-pilot scale) and corresponding

revenue projections. Clear line of sight from investment to

commercialization.

Deliverables

-

14-slide investor deck with custom process diagrams

-

Battery cost breakdown visualization with market sizing

-

Comparative process flow diagrams

-

TAM/SAM/SOM market opportunity visualization

-

Platform technology capability demonstration

-

Go-to-market timeline with market segmentation

-

Competitive positioning matrix

-

Revenue model charts showing volume, revenue, and profitability progression

-

Investment ask roadmap with production milestones

-

Team slides with advisor credentials and institutional affiliations